|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Mortgage Lenders for Temporary Workers: A Comprehensive GuideSecuring a mortgage as a temporary worker can be challenging, but it's not impossible. Many lenders understand the modern workforce dynamics and offer tailored solutions. Challenges Faced by Temporary WorkersTemporary workers often face unique challenges when applying for mortgages. Lenders typically look for stable, long-term employment, which can be a hurdle for those in non-permanent roles. Income StabilityIncome stability is a key factor for lenders. Temporary workers may have inconsistent income streams, making it harder to demonstrate financial reliability. Employment VerificationLenders often require verification of employment, which can be difficult for temporary workers whose job status frequently changes. Strategies to Improve Mortgage Approval ChancesThere are several strategies temporary workers can employ to improve their chances of securing a mortgage.

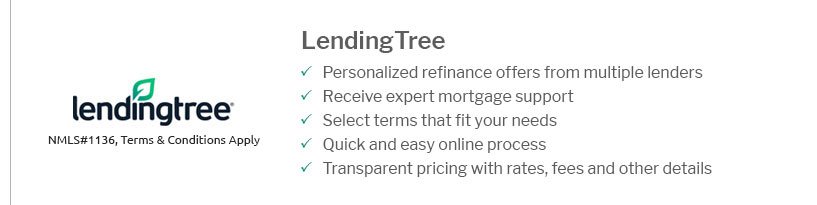

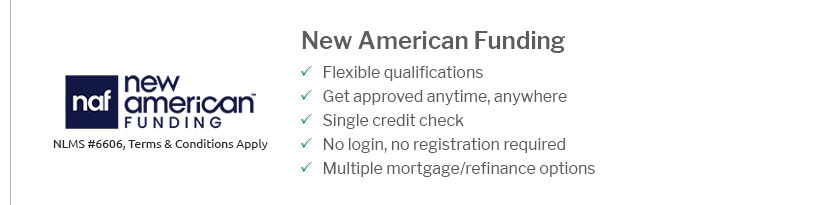

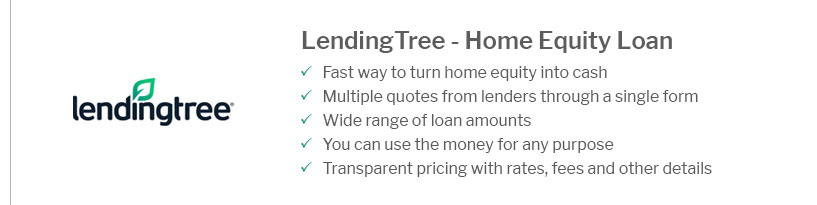

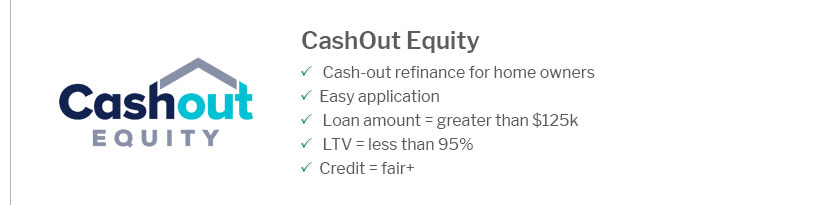

For more detailed financial strategies, consider consulting with the lowest jumbo mortgage rates experts. Choosing the Right LenderSelecting a lender who understands the needs of temporary workers is crucial. Specialized LendersSome lenders specialize in working with non-traditional employment types and offer more flexible mortgage terms. Comparing OffersIt's important to compare multiple offers to find the best terms. Resources like the best online mortgage refinance companies can provide valuable insights into competitive rates and terms. Frequently Asked QuestionsCan temporary workers get approved for a mortgage?Yes, temporary workers can get approved for a mortgage. It's essential to demonstrate financial stability through a strong credit score, comprehensive income documentation, and possibly a larger down payment. What documents are required for temporary workers applying for a mortgage?Temporary workers should prepare to provide proof of income, tax returns, bank statements, and any contracts or documentation of employment status. How can temporary workers improve their chances of mortgage approval?Improving credit scores, saving for a larger down payment, and providing thorough documentation of income and employment can enhance approval chances. https://www.reddit.com/r/personalfinance/comments/xed0ub/how_can_a_contract_worker_qualify_for_a_mortgage/

The bank can approve income any way they see fit, but the mortgage side (assuming this is not a portfolio loan) has to adhear to standard income ... https://www.newcastle.loans/mortgage-guide/staffing-agency

When you're income comes from a staffing agency, consider applying for your mortgage through a smaller lender. Unlike a big bank, a small lender ... https://www.rocketmortgage.com/learn/how-to-get-mortgage-seasonal-income

Inconsistent seasonal income will likely disqualify you from a mortgage loan. Mortgage lenders want reasonable assurance that you'll continue ...

|

|---|